Accounts

Format (continued)

6. The Balance

Finally the balance is drawn, and undersigned by the accountant David Dixon.

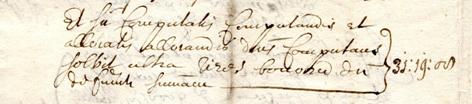

| Et Sic Computatis Computandis et allocatis allocandis d[i]c[t]us Computans solvit ultra vires bonoru[m] d[i]c[t]i defuncti su[m]am |

||

| [And thus taking everything into account and everything to be allowed this accountant has disbursed over and above the goods of the said deceased the sum] |

In this case the disbursements are greater than the credit of £20 6s 6d stated in the charge, and the account was in deficit.

7. The allocation of the balance

Sometimes accounts can include legacies in the discharge, and sometimes they are only accounted after the balance. This balance is also often then divided into third or half shares. Why and how this allocation takes place depends on a number of factors, as will become clear as we consider two simple examples from the Durham records.

Intestates' accounts

If the deceased was intestate, then the allocation of any balance remaining would be divided between the widow and children, the administrator and other next of kin. Such rights and shares were generally defined by the laws of distribution of an intestate's personal estate and which prevailed throughout southern England, and were modified and clarified in the Statute of Distributions in 1670.7

In the province of York, however, a different custom of distribution had always prevailed.8 This custom related to the distribution of both testates' and intestates' personal property: thus in this northern province even testators were severely limited in the proportion of their personal estates they could bequeath freely. The custom of York was not abolished by statute until 1692, and York City maintained its exceptional status until 1703.

Thus most surviving accounts in the Durham diocesan records, whether of testates or intestates, will operate according to the Custom of York. In the case of intestates this allocated one third of the estate to the widow, one third between the children,9 and one third - sometimes termed the death's third - to the administrator. Failing either a widow or children, then half shares were allocated. Failing a surviving widow and any surviving children, then the entire balance fell to the administrator. After 1692 the southern law of distribution also came to prevail in the northern province, and which law allocated one third to the widow and two thirds to the children or their lineal descendents; failing children, the widow took half, the other half being distributed among the next of kin; failing a widow, any children received all; failing both a widow or children, the next of kin received all.10

In the following case, taken from the 1631 probate records of the intestate George Jollie of Newcastle, the account balance was £19 1s in credit.11 This balance his wife, also the administratrix, then divided between herself and her six children.

![Allocation of thirds, from the 1631 account of George Jollie of Newcastle [Ref: DPRI/1/1631/J2/1]. Image of the allocation of thirds, from the 1631 account of George Jollie of Newcastle [Ref: DPRI/1/1631/J2/1].](images/DPRI-1-1631-J2-1_allocation.jpg)

| One third p[ar]t whereof shee desireth may be allowed to her this acc[ountant] for her thirdes being |

||

| Another third p[ar]t shee desireth may be allotted to the deceasedes six Children being the like sum[m] of 6 li 7 s vi[delice]t to ev[er]y of them |

||

| The other third p[ar]t being the deathes p[ar]t and the like sum[m] shee praieth may be allowed to the said six Children vi[delice]t to ev[er]y of them |

||

| So to the widow for her p[ar]t | ||

| And to ev[er]y of the said Children for their porc[i]ons |

We can see here that the widow generously allocated even her administrator's share among her children, so supplementing each of their portions. Had Jollie's wife Anne renounced her right to administer in favour of a friend or (if there were substantial debts) a creditor then as administrator that person would have been entitled to the full third. Had Anne predeceased her husband and the children been orphaned, then the Custom of York ensured they received half the goods, the other half passing to the administrator, who if the children were all still minors would have been appointed by the court.

Notes

7 Public Act, 22 & 23 Charles II, c. 10. The rules of distribution

remained largely unmodified throughout the time the ecclesiastical courts retained testamentary

jurisdiction, that is until 1858. Wales too had a particular distributive custom akin to the

Custom of York, and which was abolished in 1695.

8 England was and is still divided into the two ecclesiastical

provincial jurisdictions of Canterbury and York. Between the Reformation and 1858, when

probate came under civil jurisdiction, within the northern province were the dioceses of York,

Durham, Chester, Carlisle, and Sodor and Mann.

9 In the Custom of York only a child who was the heir, and so to

receive the freehold or copyhold (real) property of his father, or a child whose portion had

already been advanced in the lifetime of the testator was excluded from receiving part or all

of this children's third share. Outside of the northern province church courts still often

made disproportionate allocations in favour of children who were not the heirs, or who had

as yet received none of their due portions.

10 Until 1357 administration of intestate's estates and the administrator's

share were taken by the Ordinary, usually the bishop (Public Act, 31 Edward III, st.1, c.11).

An Act in this year stipulated that administration should be granted by the Ordinary to the

'next and most lawful friends' of the deceased. In 1529 legislation allowed administration to be

granted to the widow or next of kin (Public Act, 21 Henry VIII, c.5). Before the 1670 Statute of

Distributions the southern distributive law outlined above had allocated what became the next of

kin's share to the administrator. This had long been perceived an injustice against the next of

kin before the 1670 Act was passed. The next of kin of decedents in the northern province of York

did not begin to profit from the provisions of the 1670 Act in this regard until the Custom of York

was abolished in 1692.

11 The Probate Act Book (DPRI/4/13 f.52) records that administration and

the tuition of six children had been granted to Jollie's widow on 3 Nov 1630, probably when the

probate court was visiting Newcastle; Anne Jollie entered an administration bond on the same day.

The 1630 entry is annotated in the margin with a note that the account was exhibited on 18 July

1631, from which we might infer it had also been admitted by the court.

|

Previous page | Next page |  |